I’ve often talked about my 3-credit card system. A travel card, a cash back card, and an emergency card for monthly bill pay. When I heard Apple was launching a credit card I had some skepticism. But after some research I decided to sign up. Besides, I’m already locked into the Apple ecosystem so why not give them more of my money, lol.

The features

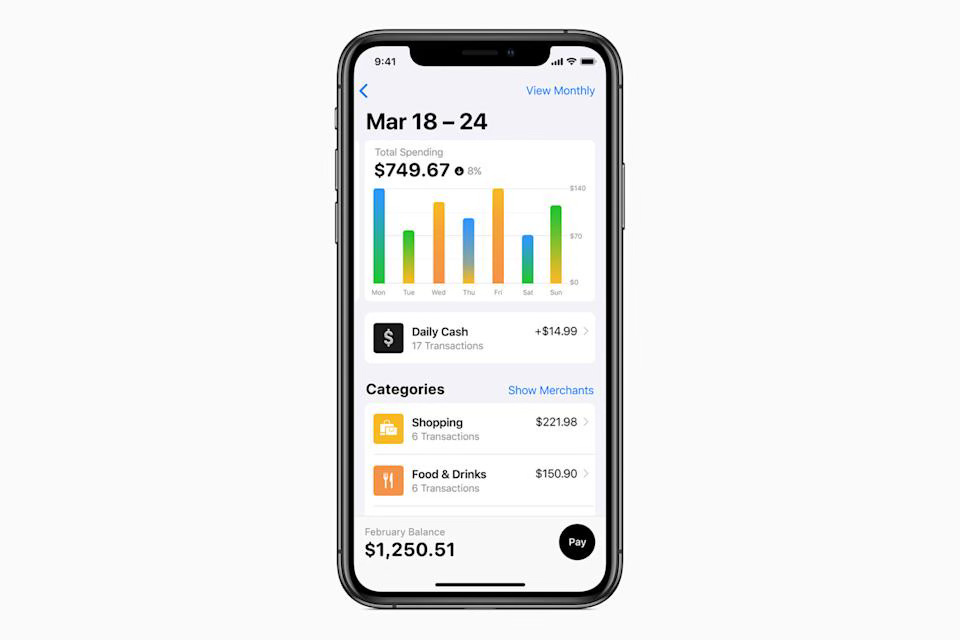

My favorite feature of the Apple Card is the unlimited daily cash back which deposits instantly. No need to wait for the monthly statement cycle. You get 3% on all Apple purchases (interest free) and from other select merchants like Nike, Exxon Mobil, and Uber. 2% back on everything else when you use Apple Pay. The 3% really helps build up your cash back when you’re paying for Apple subscriptions every month. It also has an integrated savings account you can open with a pretty good interest rate (3.75%) that deposits your cash back after every purchase. A nice perk to help you save spare change. One feature I really like is the spending categories. It really helps me track my spending for the month. It lets me know where my money outflow is going from food, entertainment, shopping, etc.

And of course, my favorite part of the Apple Card, NO FEES. None! Now this isn’t the best credit card on the market, but there is some ease of use being tied to your iPhone. Apple Pay integration of course is seamless. I’m also very enamored by the security features since it’s a digital credit card (You can order a physical card if you choose). This gives you a virtual credit card number that can be changed in any instance if your card is compromised. No having to call customer service, cancel a card and wait 7 business days for a replacement. This gives me real peace of mind.

The Apple Card isn’t for everyone. If you’re an Apple fanatic there are some major perks when going shopping for some new gadgets. If you like instant cash-back, this is the card for you. But there are many similar cards that offer more and may have sign-up bonuses and travel perks so I’d shop around. This card for me is a good number #2 in your credit card stash for everyday purchases. Morning coffee, a quick lunch, and basic monthly maintenance needs. This is NOT the card if you want airline miles and hotel points. I’d look at the Chase Sapphire or Amex instead.